Get Educated & Inspired

On The Blog

Here I am back at it again and ready to hit you with a blog I’m not an expert in (maybe I should stop saying that?) I don’t have any sort of personal finance background, but I have a personal experience background that I’d like to share with you all.

I graduated college 3 years ago (which feels like a long time ago, but it really isn’t.) So this blog is perfect for those who are either fresh out of college or millennials in their 30’s (or both.)

Are you in debt? Almost everyone is after college – approximately 45 million people. I have student loan debt too! But that doesn’t mean you have to go curl up in a cardboard box, either.

I’m living in LA and can afford a 2 bedroom apartment by myself, and if you’re familiar with the cost of living in LA or any major city, it’s outrageous.

So you’re probably wondering how in the world can I afford a 2 bedroom apartment AND have student loan debt? Well, I’m about to share with you how I manage my money.

Let me preface this by saying that this may seem atypical to you. I am disciplined and smart with my money (or I try to be, at least.) But hear me out for a second.

Related Posts:

Save Save Save

Ahh, the good old savings account. We always hear people talk about an emergency fund, right? Well this is an important thing to have.

Ideally, this is something that you’ll want to put away so that you can’t touch it on a daily basis. Hence the name “Emergency” fund. Meant for emergencies.

I strongly recommend starting a savings account ASAP. Thankfully my parents started one for me when I was little, and very slowly helped me build it up until I was old enough to take it over myself.

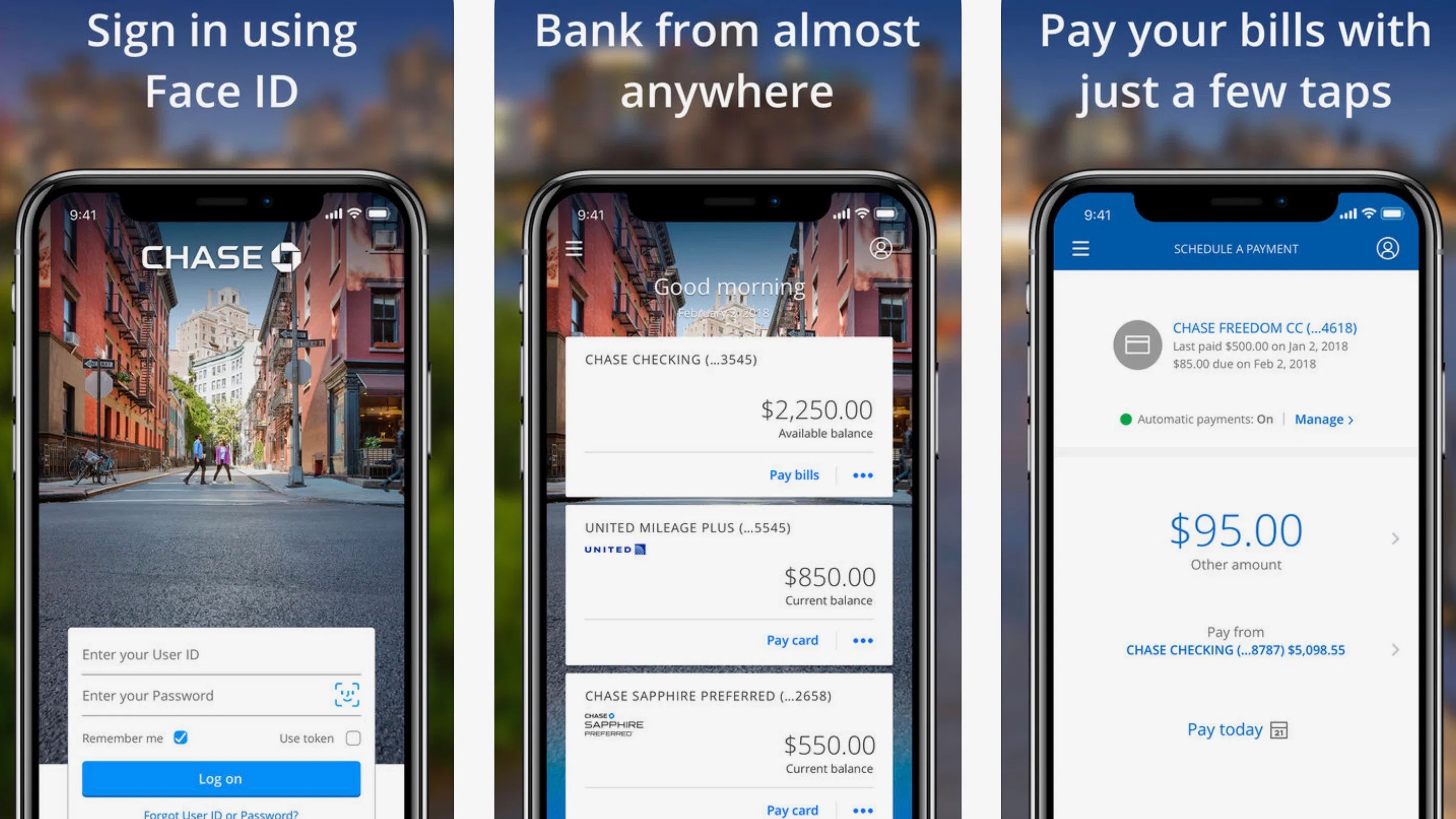

I’m very grateful for their help on this. If you haven’t opened up a savings account, it couldn’t be any easier to do so. Most banks have an app these days and you can open a savings account within minutes on the app.

Chase has an app that is really easy to use and navigate – if you don’t bank with them currently, they’ve been great to work with and I can’t recommend them enough.

It’s easy to make transfers, pay bills, and I personally enjoy being able to log in with face ID. There’s nothing more annoying than multiple failed login attempts.

Could you imagine if you started out by putting $25 per paycheck into a savings account? It may not seem like much, but let’s say if you get paid twice a month for a year, that’s $600.

Or if you’re able to put away more, maybe $100 per paycheck for a year, that would be $2,400. Whatever amount you’re most comfortable, every little bit helps!

Evaluate Your Spending Habits

Be honest with yourself here. What are your spending habits?

Do you have a lot of credit card debt? Are you shopping more than necessary?

Are you visiting the Starbucks drive thru 5 days a week? Are you spending hundreds of dollars in alcohol? What are some areas you could cut back?

Sit down with your bank statement and highlight all the times you’ve eaten out or went to the bars. How much did you spend?

I recently sat down with my bank statement for the month of April, and I highlighted $300 alone in just eating out.

If I averaged that out to spending that much per month for a year, I would spend $3,600 on eating out. This was crazy to me! While I enjoy a good meal out, I definitely knew I could do better to cut back on this.

Okay, I will admit I have a *mild* obsession with Starbucks iced chai’s.

So I completely understand the desire for coffee or your favorite drink to start the day. But let’s calculate this for a second.

Let’s say you go to Starbucks 3 days a week and spend an average of $6 per visit. If you did this for a year, you would be spending $864 in just coffee! That $6 doesn’t seem like a lot when you’re handing over your credit card at the drive thru window, but it adds up quick.

I don’t drink alcohol so I’ve never really had an issue with this, but let’s say you go to the bars each weekend to hang out with friends and somehow you rack up your bill to $100.

If you did this one weekend a month for an entire year, that would be $1,200! See where I’m getting at with this?

Now remember that the purpose of this isn’t to make you feel attacked – it’s to raise awareness within yourself. If you’re a recent college grad and strapped for cash, really consider your spending habits and work out a solution that works for you.

Explore Your Streams Of Income

One thing I’ve learned over time is that there’s actually no reason why you have to be limited to one source of income.

A lot of people will work one full time job and think that the salary they’re making is what they get. And it starts with changing your mindset and having discipline.

There are so many things you can do these days to bring in a little bit of income on the side. It doesn’t have to be thousands of dollars – think small to start out.

One thing you can do some research on is how to get into the stock market. Investing long term is a great low-risk option to put in some money and take it out 10-20 years later when it becomes time to buy a house. This is considered a source of income.

Another thing you could do is to pursue your hobbies and determine if you can turn it into a side hustle.

Do you have a passion for all things organic? Maybe you could start up an etsy store and sell reusable containers for food, cosmetics, etc.

Do you have a passion for music? Maybe you could arrange some music for a local high school band.

You could even get into flipping and selling items on Amazon for some extra cash.

However, the only way for these things to work is if you put in the work. This money won’t come to you naturally, so you’re going to have to be disciplined and work at it.

By giving yourself this flexibility, you’re allowing yourself to bring in more than one source of income. And that will help you pay off your debt and keep you out of a cardboard box.

Work On Paying Down Your Debt

This one might seem kind of obvious, but work through a budget sheet for yourself.

This will help you determine what your monthly expenses are and what you can afford. If you have credit card debt, now is the time to start working through some of that if you haven’t done so already.

In addition to putting away some money into a savings account, determine how much you can set aside each month to put toward student loan debt and/or credit card debt.

Student loan debt can be really difficult to tackle, especially if you have a lot of it. Need something to motivate you to pay it off sooner? Here it is.

You are paying an absurd amount of interest on your loans (and this is the same for credit card debt too).

This means that you are literally paying extra money, more money than what your actual loans cost!

If this doesn’t make you furious and want to pay off your loans sooner, then I’m not sure what will!

If you have a credit card and you’re a wild spender, be careful. This is exactly what credit card companies want.

They want to get their cards in your hands because if you don’t make your monthly payments on time and in full, guess what? You’ll be paying interest (aka “extra money”) in addition to the money you’ve already spent.

And guess where that “extra money” goes? Banks and credit card companies.

It’s really important to be disciplined with your credit card – if you can’t afford to pay off the entire amount in full each month, it’s probably not in your best interest to use a credit card right now.

This is where a debit card comes in handy, because anything you purchase will immediately be taken out of your account.

Get A Good Job

Getting a good job can often be a little far fetched..but it doesn’t have to be.

I did manage to get lucky with the full time job I landed here in LA. My salary supports me well enough to afford my monthly expenses and have a little bit remaining to stow away into my savings account.

One thing I will say is that this doesn’t happen to everyone, but it can. Do your research.

What available jobs are in your area and how much do they pay?

Do your skills align really well with the position? Do you see yourself being able to negotiate the salary?

The only thing standing between you and a decent-paying job is your mindset.

Continue to modify your resume. Check and recheck. Have a family member read over it thoroughly. If there are any errors, your resume most likely won’t be considered.

Make sure you are maximizing yourself and displaying your full potential to employers.

There is nothing more valuable to an employer than someone who is trustworthy and dependable. Well, there might me other things that are valuable too, but those two things are a great start.

Taking these things into consideration, this part is not easy and also requires diligent work. Be patient with yourself, but be disciplined.

This will help you pay your bills and maybe a nice pair of Yeezy’s or something extra for yourself.

Give It Some Time

It’ll take some time and a lot of hard work to do the things listed above. But it’s entirely possible!

As long as you have the mindset and the discipline, you will succeed.

There are so many success stories out there about people paying off all their debt shortly after college, buying their first house in their early 20’s, and so on.

These people exist, and they’re out there doing it. So if they can do it, you can too!

Share your thoughts in the comments below – what’s your experience been like? Are you struggling with student loan debt after college?

Leave a Reply Cancel reply

We create professional photo and video content for brands and products.

Get in touch

What's your vision? Let's make it a reality together.

HOME

ABOUT

Services

Sales page

Contact

[…] 5 Helpful Tips To Determine Your Career Path How To Manage Your Money After College […]